ad valorem tax florida statute

Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now. Title XIV TAXATION AND FINANCE.

Terms To Know Before You Start Your Home Search Real Estate Terms Home Buying Process Real Esate

What is ad valorem tax exemption Florida.

. 1 AD VALOREM TAXES. 1 Each veteran who is age 65 or older and is partially or totally permanently disabled shall receive a discount from the amount of the ad. 2021 Florida Statutes Including 2021B Session Charter school exemption from ad valorem taxes.

The 2022 Florida Statutes. 1 AD VALOREM TAXES. 1961983 Charter school exemption from ad valorem taxes.

1 MILLAGE AUTHORIZED NOT TO EXCEED 2 YEARS. Chapter 193 ASSESSMENTS Entire Chapter. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption.

2018 Florida Statutes. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. The 2022 Florida Statutes.

1 AD VALOREM TAXESAn elected board shall have the power to levy and assess an ad valorem tax on all the taxable property in the district to construct. Title XIV TAXATION AND FINANCE. All property of the United States is exempt from ad valorem taxation except such property as is subject to tax by this state or any political subdivision thereof or any municipality under any law of the United States.

See Florida Statutes 101. 101173 District millage elections. VII of the State Constitution.

2 Any taxpayer who objects to the assessment placed on any. Impact fees and user charges. Chapter 196 EXEMPTION Entire Chapter.

Body authorized by law to impose ad valorem taxes. The term non-ad valorem assessments has the. 193155 Florida Statutes limiting the application of that section only to the residence and curtilage.

1 AD VALOREM TAXES. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now.

The amendments do not affect the provisions set forth in s. Such leasehold or other interest shall be taxed only. The district school board pursuant to resolution adopted at a regular.

An elected board may levy and assess ad valorem. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real. Ad Access Tax Forms.

Such ad valorem taxes non-ad valorem assessments and utility charges shall be a part of the lot rental amount as defined by this chapter. The Property Tax Oversight PTO program publishes the Florida Ad Valorem Valuation and Tax Data Book twice a year. Complete Edit or Print Tax Forms Instantly.

Title XIV TAXATION AND FINANCE. Authorized by Florida Statute 1961995. Florida Statutes 2005 subject to the provisions of subsection 7.

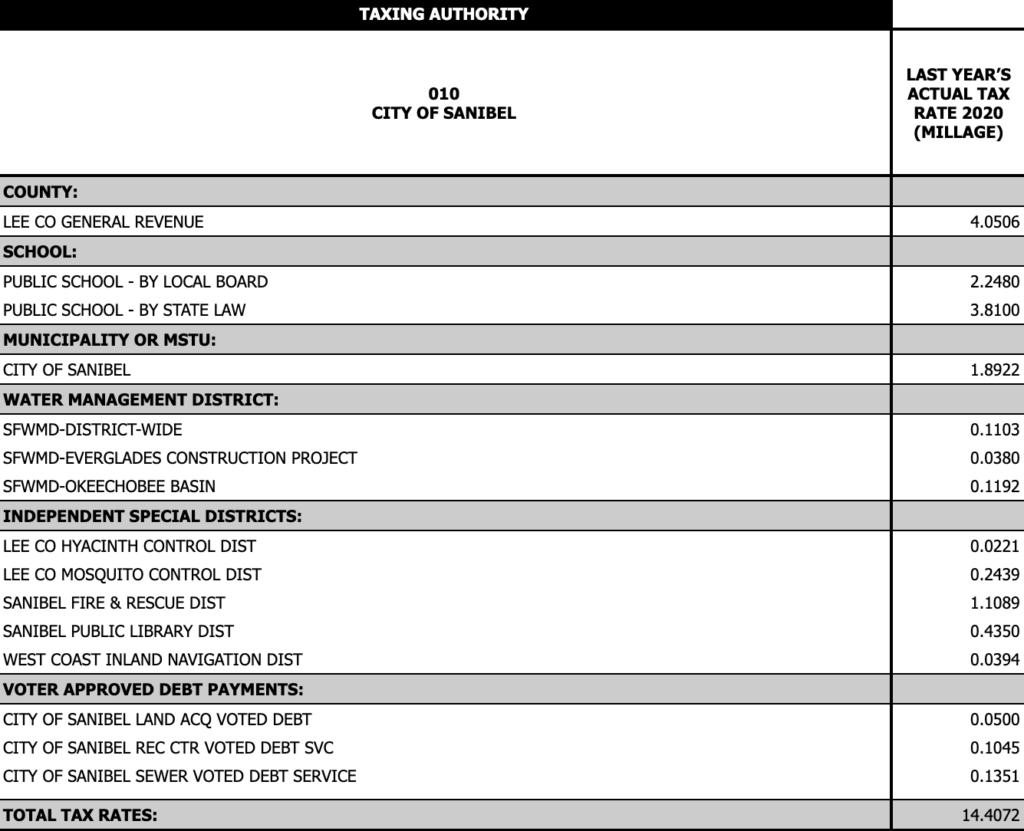

9 Levy means the imposition of a tax stated in terms of millage against all appropriately located property by a governmental body. 2020 Florida Statutes. Millage may apply to a single levy of taxes or to the cumulative of all.

2022 Florida Statutes Back to Statute Search. Any facility or portion. 1973632 Uniform method for the levy collection and enforcement of non-ad valorem assessments.

Impact fees and user charges. 194037 Disclosure of tax impact. Property subject to taxation.

1 Each taxpayer whose property is subject to real or tangible personal ad valorem taxes shall be notified of the assessment of each taxable item of such property as provided in s. An elected board shall have the power to levy and assess an ad valorem. An elected board may levy and assess ad valorem taxes on all taxable property in.

The 2022 Florida Statutes. 10 Mill means one onethousandth of a - United States dollar. Ad valorem taxes and non-ad valorem assessments shall be assessed.

The 2022 Florida Statutes. A Levy means the imposition of a non-ad. An ad valorem tax or non-ad valorem assessment including a tax or.

1 196082 Discounts for disabled veterans. In August PTO releases the first publication which contains.

Florida Luxury Home Sales Were Up 5 Percent In The Third Quarter The Fourth Straight Quarter Of Outperforming The National Marke Luxury Homes Florida Marketing

Florida Property Taxes Explained

Property Taxes Highlands County Tax Collector

How Easements Legally Affect Your Real Estate Investment Florida Law Real Estate Investing Estate Law

Florida Revenue Floridarevenue Twitter Tax Holiday Disaster Preparedness Preparedness

Florida Property Taxes Explained

Florida Rental Property Owners Tax Deductions For 2021 Returns Central Florida Property Management Orlando Property Management Company

Florida S State And Local Taxes Rank 48th For Fairness

What Is A Substitute For Return Estate Tax Inheritance Tax Tax Preparation

Florida Property Taxes Explained

How To Calculate Fl Sales Tax On Rent

Those Who Have A Better Grasp Of Tax Technicalities And Opportunities For Economic Growth Will Always View Estat Estate Planning Florida Real Estate Estate Tax

After The Retail Apocalypse Prepare For The Property Tax Meltdown Meltdowns Tax Lawyer Property Tax

A Realtor Is Not A Salesperson They Re A Matchmaker They Introduce People To Homes Until They Fall In Love With On Wedding Planner Matchmaker Estate Lawyer

Florida Real Estate Taxes What You Need To Know

Ecommerce Businesses Can Integrate Shopping Carts Automatically From Walmart Amazon Shopify And Ebay Online Taxes Filing Taxes Florida Department

Proper Procedure In Every Court Filing Is Non Negotiable And Inevitable In The Justice System This Is No Different With The Court Fi Invalidity Proper Justice